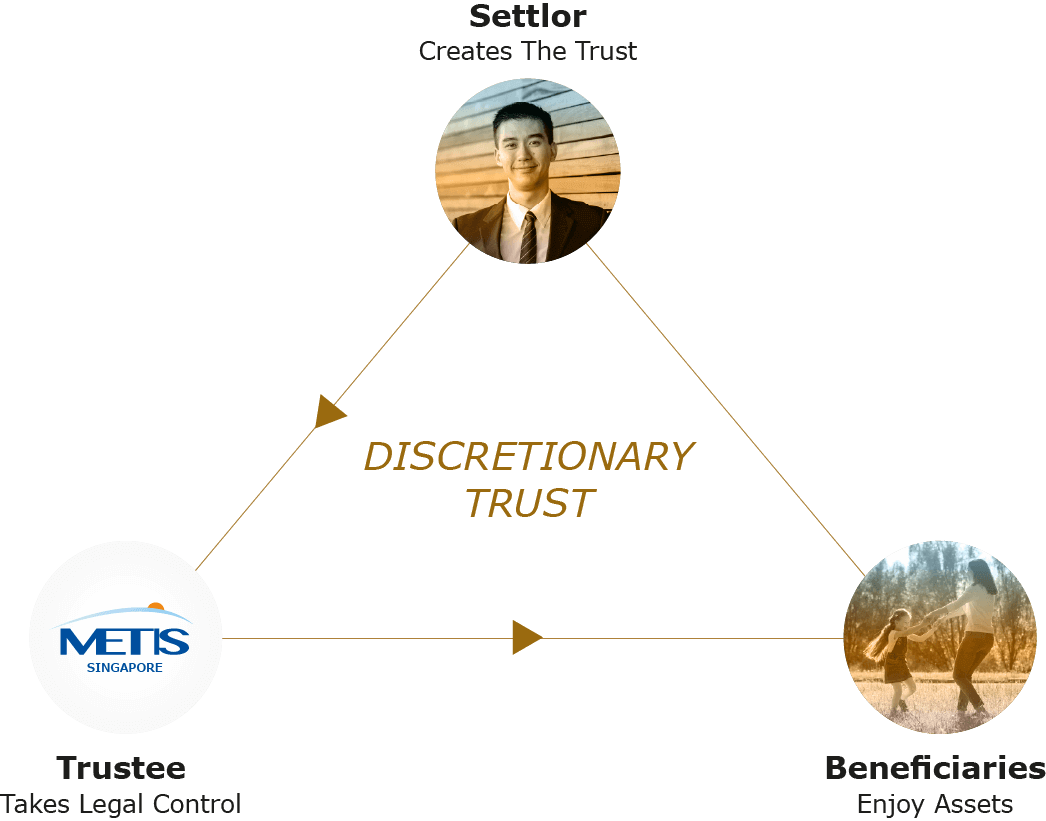

Concept of Trust

A Trust separates the legal title from the beneficial interest of any Trust asset that is transferred into the Trust by you, the settlor. Following such separation, the legal title of the Trust asset will be held in the name of the trustee while the beneficial interest of the Trust asset will rest in the beneficiaries of the Trust.

The trustee has the power (and duty) to manage, administer, employ or dispose of the assets, in accordance with the terms of the Trust and, to a certain extent, your letter of wishes – which is a document that contains recommendations from the settlor regarding the distribution of the Trust assets to the beneficiaries. Such arrangements typically offer a degree of protection to the Trust assets whilst ensuring that the Trust assets will be distributed at the appropriate juncture.

The reservation by the settlor of certain rights and powers, and the fact that the settlor may himself/herself be a beneficiary, are not necessarily inconsistent with the existence of a Trust.

Trust and Will

Most individuals use Wills to state their intentions for how their wealth should be distributed after death, and may mistake Trusts for being similar.

However, the differences are vast. Compared to a Will, a Trust is generally able to provide greater levels of asset protection and privacy, as well as ensure a faster asset distribution process.

These are some of the key differences between a Trust and a Will.

| FEATURES | TRUST | WILL |

|---|---|---|

| Purpose |

A Trust outlines how your assets are to be managed during your lifetime, as well as after death.

Court intervention is not required, so the distribution of your assets does not require the court's supervision (and is generally much faster). |

A Will is a written document detailing the distribution of your estate upon your death. It is revocable and subject to amendment at any stage during your lifetime |

| Effect | A Trust takes effect as soon as you create it. | A Will comes into effect only upon your death. |

| After Death | A Trust can be used to distribute assets before and after death. | A Will is a document that directs who will receive your property after your death, and it appoints a legal representative to carry out your wishes. |

| Probate Process | A Trust passes outside of probate, so a court does not need to oversee the process – which can save time and money. | A Will passes through probate – a process that has a court overseeing the administration of your Will, ensuring it is valid, and distributing your estate accordingly to your Will. |

| Confidentiality | A Trust can remain private even after your death, and is often preferred by individuals who wish to keep their assets and beneficiaries private. | Upon probate, the contents of a Will enter the public domain. Anyone who applies to see the case file can potentially see how your estate is distributed and who your beneficiaries are. |

Trust often goes overlooked in daily conversations within the current market space. We aim to educate more people about the importance of Trust, making it simple and easy to understand through these advertorial materials.

What are the differences between a Will and a Trust? What are the benefits of establishing a Trust? And, is setting up a Trust affordable?

Are Trusts only for the wealthy? Why are Trusts essential for everyone? Gain more insights to better understand the importance of Trusts.

What is a Trust, why should you bother setting one up, and is it safe to put your money in a Trust Fund?

What's the difference between a Will and a Trust and how can they work together in your estate and legacy planning?

Trusts are a useful financial planning tool for anyone with dependents, but especially for those with vulnerable beneficiaries, such as children, individuals with special needs and the elderly.

It’s never pleasant when families fight over money. How can trusts help to ensure fair and equitable asset distribution – and maintain family harmony at the same time?

Introducing Metis SG and discussing the importance of trust. Our deputy CEO, Alex Ng, is going to discuss the benefits of trusts and Metis SG's role in helping the process of establishing one.

In this video, Hock Beng discusses the importance and benefits of setting up a family trust. With Metis Trust plans, he can now offer this valuable financial tool to his clients, helping them complete their estate legacy planning.

Regina will highlight the importance of planning for elderhood. She will emphasize that proactively preparing for this stage of life can help you and your family manage unexpected situations, ensuring a smoother transition and providing peace of mind for all involved. By addressing potential challenges early, you can make informed decisions that protect your future well-being and financial security.

In this episode, we have Mr. James Chen (CEO of Athena Best Singapore) to talk about why it is important to consider incorporating trusts as part of estate planning. He will highlight how trusts can be used to meet the unique needs of different individuals in providing peace of mind and security for them and their loved ones.

In this episode, Islamic Wealth Advisory specialists Surina and Zaid address common dilemmas and provide insights into estate planning from an Islamic perspective. They will discuss the advantages of incorporating Trusts alongside a Wasiat to ensure your assets are managed according to your wishes and Islamic principles.

In this episode, we have Mr. Kartono Kang (CEO) and Ms. Kartina Kang (Managing Director) of PAFA Financial Advisory Pte Ltd to briefly share on the shifting purchasing market trends. With the abundance of information and changing lifestyles, many individuals are seeking new experiences and options. As singlehood becomes more common, how Trust can be used to assist single individuals during their lifetime with asset protection and then passed down the remaining assets to someone special or even to a charity.

In this episode of In Trust We Share, we are joined by Mr. Tea Eng Peng from Financial Alliance, the largest independent financial advisory firm in Singapore. He shares insights on how trusts can protect entrepreneurs’ personal assets, ensure smooth wealth transfer to the next generation, and effectively manage various risks. Mr. Tea also discusses the importance of optimizing tax burdens and safeguarding against liabilities, while establishing a foundation for long-term business continuity.

In this latest episode of In Trust We Share, we speak with Syed Afiq Bin Syed Ismail, Chartered Financial Consultant and Associate Estate Planning Practitioner at Financial Alliance. He shares why a Wasiat alone may not be sufficient to fully protect your assets and loved ones, and how trusts can work alongside Faraidh to create a comprehensive, Shariah-compliant estate plan. From safeguarding children’s inheritance to managing CPF and insurance payouts, discover how Muslim families can build a secure and lasting financial legacy.

A quick step-by-step guide on how to perform an asset switch on the Client Portal for SapphirePRO & CitrinePRO.

A quick step-by-step guide on how to perform asset future redirection on the Client Portal for SapphirePRO & CitrinePRO.

Short Clips

Potential benefits of having a Trust and a simple fee structure offered by Metis Trust Plans

Why is the role of a Contingent Investment Adviser important, and what responsibilities does it entail?

Have you considered providing your children with a head start in life, and if so, what are the reason behind this consideration?

Unforeseen circumstances are beyond our control, yet we possess the ability to safeguard our wealth from them

There are alternative options for initiating retirement planning. Are you aware that having a Trust provides a broader range of distribution options for you to choose from?