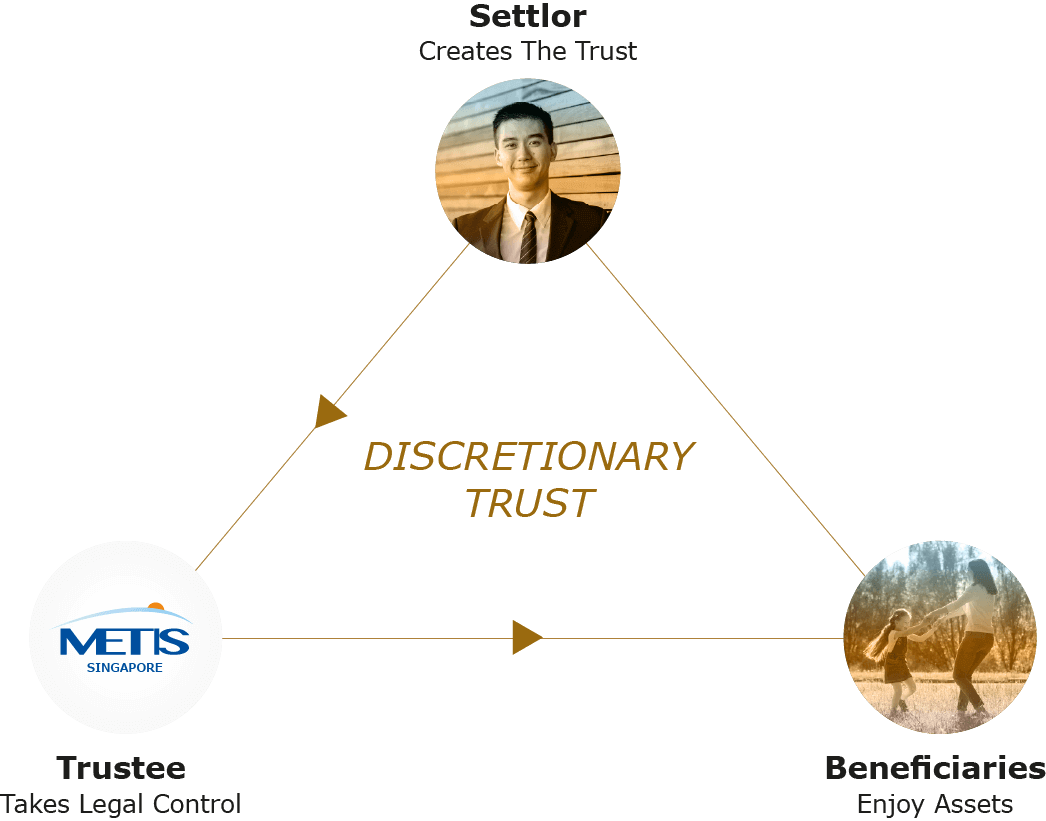

Concept of Trust

A Trust separates the legal title from the beneficial interest of any Trust asset that is transferred into the Trust by you, the settlor. Following such separation, the legal title of the Trust asset will be held in the name of the trustee while the beneficial interest of the Trust asset will rest in the beneficiaries of the Trust.

The trustee has the power (and duty) to manage, administer, employ or dispose of the assets, in accordance with the terms of the Trust and, to a certain extent, your letter of wishes – which is a document that contains recommendations from the settlor regarding the distribution of the Trust assets to the beneficiaries. Such arrangements typically offer a degree of protection to the Trust assets whilst ensuring that the Trust assets will be distributed at the appropriate juncture.

The reservation by the settlor of certain rights and powers, and the fact that the settlor may himself/herself be a beneficiary, are not necessarily inconsistent with the existence of a Trust.

Trust and Will

Most individuals use Wills to state their intentions for how their wealth should be distributed after death, and may mistake Trusts for being similar.

However, the differences are vast. Compared to a Will, a Trust is generally able to provide greater levels of asset protection and privacy, as well as ensure a faster asset distribution process.

These are some of the key differences between a Trust and a Will.

| FEATURES | TRUST | WILL |

|---|---|---|

| Purpose | A Trust outlines how your assets are to be managed during your lifetime, as well as after death. Court intervention is not required, so the distribution of your assets does not require the court's supervision (and is generally much faster). |

A Will is a written document detailing the distribution of your estate upon your death. It is revocable and subject to amendment at any stage during your lifetime |

| Effect | A Trust takes effect as soon as you create it. | A Will comes into effect only upon your death. |

| After Death | A Trust can be used to distribute assets before and after death. | A Will is a document that directs who will receive your property after your death, and it appoints a legal representative to carry out your wishes. |

| Probate Process | A Trust passes outside of probate, so a court does not need to oversee the process – which can save time and money. | A Will passes through probate – a process that has a court overseeing the administration of your Will, ensuring it is valid, and distributing your estate accordingly to your Will. |

| Confidentiality | A Trust can remain private even after your death, and is often preferred by individuals who wish to keep their assets and beneficiaries private. | Upon probate, the contents of a Will enter the public domain. Anyone who applies to see the case file can potentially see how your estate is distributed and who your beneficiaries are. |